Walgreen Profit-Sharing Retirement Plan is a defined contribution plan with a profit-sharing component and 401k feature. 2 1 My Total Retirement refers to the managed account services available in the Empower Retirement Advisory Services suite of services offered by Advised Assets Group LLC a registered investment advisor.

Is being sued for 300 million by a group of its 401 k plan participants who allege that the company breached its fiduciary duties by adding to the plan a group of poorly performing funds and keeping them for nearly a decade despite their lackluster.

Walgreens retirement savings plan. To help ensure a dependable cash source later in life numerous workers rely on employer-provided pension plans. Provides pension plans for their employees. Learn more.

Is at the center of a proposed class action lawsuit that claims the pharmacy and the respective administrators of its retirement plan and trust fund have robbed plan members of over 300 million in retirement savings by investing the money in a suite of historically underperforming funds. Learn more about consolidating outside assets into your plan. Indirect Compensation Paid by Plan Total Compensation.

1 As of January 4 2021. The complaint asserts data compiled by Morningstar Inc. AccuCustomizationmetaTagsdescription logon authenticationerrorMessage translateauthenticationerrorMessageParams logonlogonTitle translate.

Examples of this type of plan are 401k 401a Employee Stock Ownership Plan ESOP Savings Plans and Profit Sharing Plans. 3 As of December 31 2020. The Walgreens Profit-Sharing Retirement Plan helps employees reach their retirement savings goals.

Plan Administrator Recordkeeping fees Employee plan sponsor Employer Administrator. Health savings accounts HSAs provide an additional opportunity to save for healthcare in retirement and can offer triple tax savings. CODES 8 days ago COUPON 7 days ago 4 days ago walgreens employee purchase program 1 months ago walgreens retiree employee discount programThe Department of Administrative Services DOAS has established the Employee Purchasing Program EPP in accordance with the OCGA 45-7.

The lawsuit brought by 12 current and former participants in the 103 billion Walgreen Profit-Sharing Retirement Plan claims the pharmacy chain loaded its 401 k plan with a suite of poorly. 25000 for all other hourly-paid team. Supply 90-day supply VALUE GENERICS.

Investment management fees paid directly by plan Investment management fees paid indirectly by plan. To speak with a representative regarding your account contact us Monday - Friday between 6 am. This plan is in the top 15 of plans for Total Plan Cost.

Suit says poorly performing funds were devastating to retirement accounts. Benefit-eligible hourly and salaried team members are eligible for company-paid term life insurance at a benefit equal to. Has allowed the plaintiffs to project the Walgreens Plan lost upwards of 300 million in retirement savings since 2014 because of Walgreens decision to retain the Northern Trust Funds instead of removing them.

Talk to us about options for your retirement savings. Register here to get online and phone access to your account virtually any time of the day or night. Employer Verified Available to.

Walgreen Profit-Sharing Retirement Plan currently has over 249500 active participants and over 118B in plan assets. 15 times annual base salary for all salaried team members and registered pharmacistsnurses all hourly-paid coordination band team members and above and assistant store manager. Generic medications members get even more savings on three tiers of value-priced generics The price for a generic drug is based on its tier and whether its a 30-day or 90-day supply.

Dont have prescription insurance. Individuals and organizations refers to all retirement business of Great-West Life Annuity Insurance Company and its subsidiaries and affiliates including Great-West Life Annuity Insurance Company of New York marketed under the Empower Retirement brand. Employer Verified Available to US-based employees Change location.

WALGREEN PROFIT SHARING RETIREMENT PLAN is a Defined Contribution Plan which has an account specified for the individual employee where a defined amount is being contributed to the plan by the individual the employer or both. 2 As of January 4 2021. Mountain time and Saturdays between 7 am.

Join Walgreens Prescription Savings Club for special cash price discounts on thousands of brand-name and generic medications. Walgreens offers a Profit-Sharing Retirement Plan to eligible employees. Preparing for a financially secure retirement is something we all need to do regardless of our age.

Walgreens Retiree Employee Discount Program. This plan has a BrightScope Rating of 63.

Walgreens Profit Sharing Plan Official Login Page 100 Verified

Walgreens Profit Sharing Plan Official Login Page 100 Verified

Class Action Walgreens Mismanaged Retirement Funds Cost Workers 300m By Investing In Underperforming Funds Cook County Record

Class Action Walgreens Mismanaged Retirement Funds Cost Workers 300m By Investing In Underperforming Funds Cook County Record

Walgreen Co Benefits Perks Payscale

Walgreen Co Benefits Perks Payscale

Walgreens Your Retirement Plan

Walgreens Your Retirement Plan

Walgreens Employee Benefit Retirement Plan Glassdoor

Walgreens Employee Benefit Retirement Plan Glassdoor

Walgreens 401k Funds Class Action Lawsuit Retirement Funds In Trouble Consider The Consumer

Walgreens 401k Funds Class Action Lawsuit Retirement Funds In Trouble Consider The Consumer

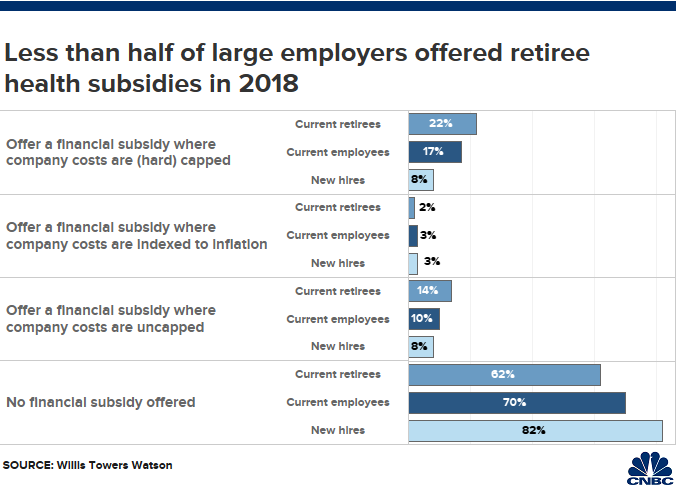

Walgreens Cuts Longtime Health Benefit For Retired Employees

Walgreens Cuts Longtime Health Benefit For Retired Employees

Walgreens Profit Sharing Plan Official Login Page 100 Verified

Walgreens Profit Sharing Plan Official Login Page 100 Verified

Walgreen Co Investing Presentation Ppt Video Online Download

Walgreen Co Investing Presentation Ppt Video Online Download

Walgreens Cuts Long Time Health Benefit For Retired Employees In Unusual Move Ufcw Local 99

Walgreens Cuts Long Time Health Benefit For Retired Employees In Unusual Move Ufcw Local 99

Walgreens Your Retirement Plan

Walgreens Your Retirement Plan

Walgreens To Face 300m Class Action Over Poorly Performing 401 K Top Class Actions

Walgreens To Face 300m Class Action Over Poorly Performing 401 K Top Class Actions

Walgreen Co Investing Presentation Ppt Video Online Download

Walgreen Co Investing Presentation Ppt Video Online Download

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.