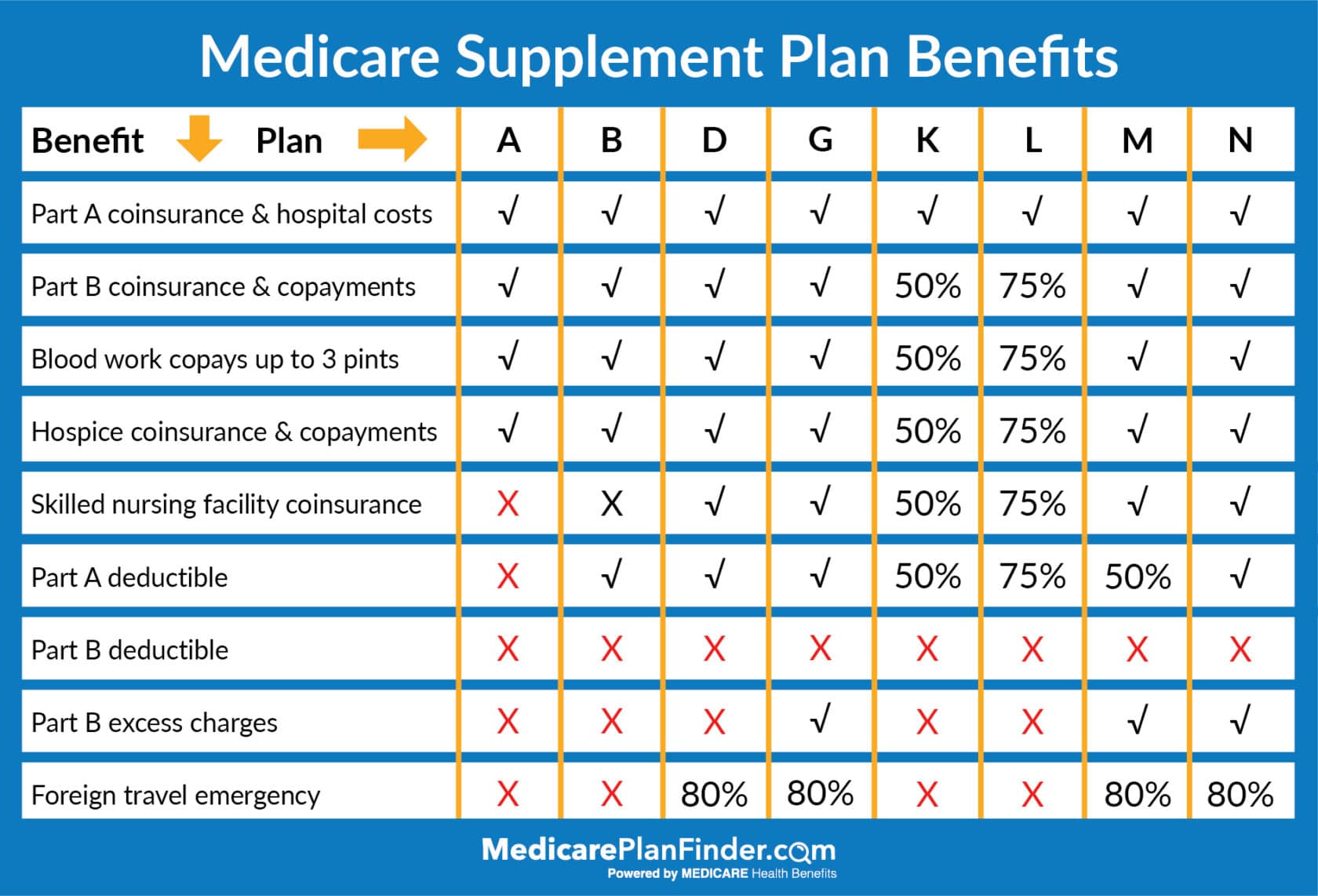

Please refer to. Medicare Supplement Plan G is rapidly gaining popularity among New Hampshire seniors.

Https Www Nh Gov Insurance Consumers Documents 2020 Medicare Supplement Rates Pdf

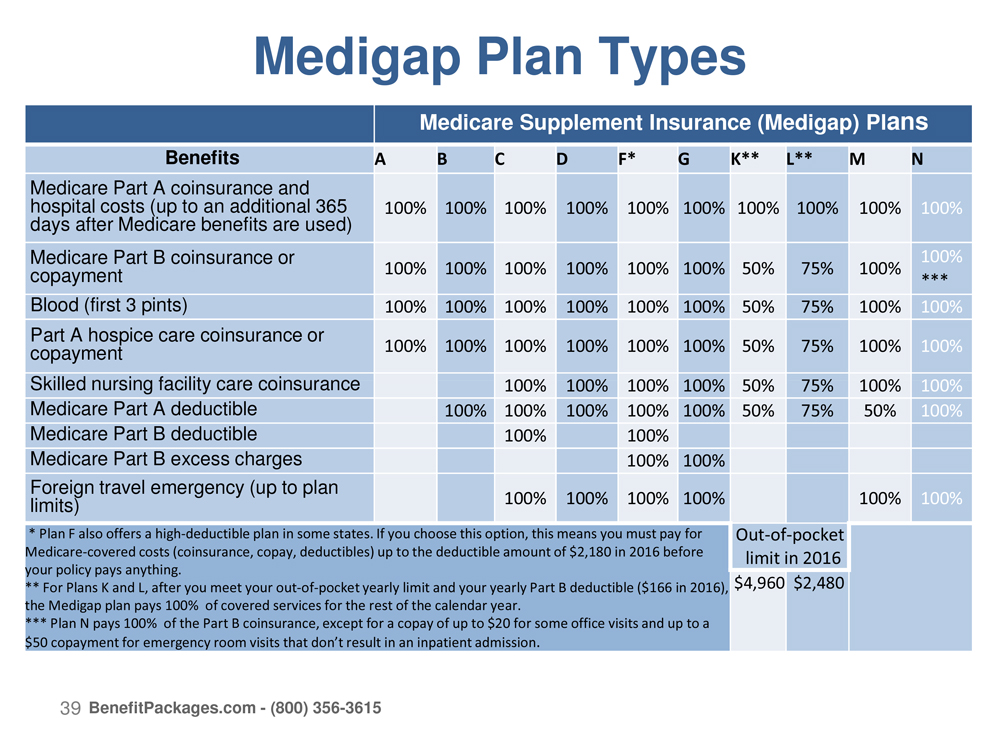

A limited number of people can buy the NH Medicare Supplement Plan F in 2020.

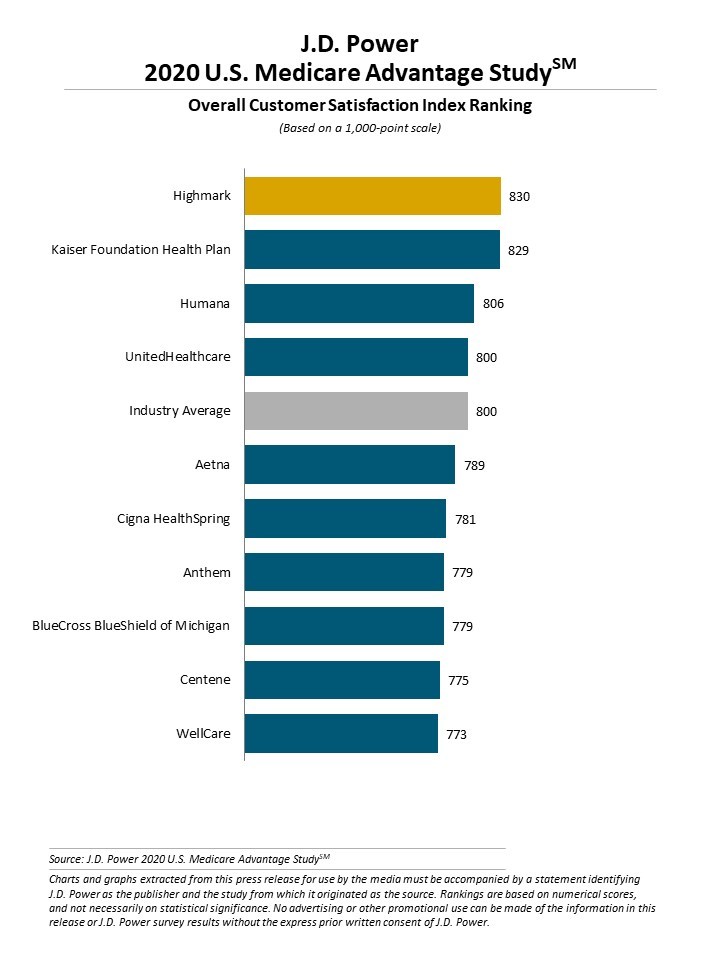

Nh medicare advantage plans 2020. For more information on a particular plan click on the plan name. The average Medicare Advantage monthly premium slightly decreased in New Hampshire compared to last year. Best Types of Medicare Advantage Plans in New Hampshire for 2020 PPO Preferred Provider Organization Plans PPO in New Hampshire.

The State of New Hampshire SONH Retiree Health Benefit Program includes both Medicare and Non-Medicare Retiree plans. HMO PPO Private Fee-for-Service Special Needs Plans HMO Point of Service Plans Medical Savings Account Plans. 40 Medicare Advantage plans are available.

It does not cover minor medical for things like vision hearing dental and it does not offer prescription drug coverage. 23 Medicare Advantage Plans available in Belknap County NH. There are 31 Medicare.

Stand-alone Prescription Drug Plans available in NH. Here are the 10 best Medigap Plan G policies available in New Hampshire based on our reviews click for details. The Medicare Advantage plans available in New Hampshire can include minor medical benefits but are not required to.

With Plan F going away in 2020 it is expected to be the new gold standard. 2020 Hillsborough County New Hampshire. New Hampshire AARP Medicare Advantage Plans.

The average monthly Medicare Advantage premium changed from 4188 in 2019 to 4023 in 2020. CMS updates the Medigap plan deductible amount each year. If you already have either of these two plans or the high deductible version of Plan F or are covered by one of these plans before January 1 2020 you will be able to keep your plan.

The Medicare Retiree plan provides medical and prescription drug coverage to those retirees and covered dependents who are eligible for and enrolled in Medicare Parts A and B due to attaining age 65 or having been deemed totally disabled by the Social Security Administration. Special Needs Plans SNPs in New Hampshire. If you choose this option you must pay for the Medicare covered costs up to the 2020 deductible amount of 2340.

Plan G does not cover the Medicare Part B deductible however counts your payment of the Part B deductible toward the edigap M plan deductible. In order for a Medicare Advantage plan to be considered a top-rated plan it must have four or more stars out of five stars. This provides you with the coverage of Medicare Part A and Part B with additional coverage for prescription drugs or services not covered in Original Medicare.

Each year the Centers for Medicare Medicaid Services CMS issues Star Ratings for all Medicare Advantage plans using a system of one to five stars. Medicare HMOs are one of the Medicare Advantage Plan options available the coverage is the same doctor and hospital services as the original Medicare program but out-of-pocket costs for these services are usually different. 100 percent of people with Medicare have access to a Medicare Advantage plan.

A total of 306948 residents of New Hampshire are enrolled in Medicare. Traditional Medicare covers about 80 of all major medical costs. This refers to the Medicare Advantage Plans that are available from the Medicare-approved private carriers in New Hampshire.

Therefore Plans C and F will no longer be available to people new to Medicare starting on January 1 2020. Top-rated Medicare Advantage Plans in New Hampshire 2020. New Hampshire Medicare Advantage Plans Explained.

185 combined in-network and out -of-network. New Hampshire Group Medicare Advantage Plans. HMO Health Maintenance Organization Plans HMO in New Hampshire.

New Hampshire UnitedHealthcare Medicare Advantage Plans. Stand-alone Prescription Drug Plans available in NH. Medicare Advantage Plans a type of Medicare health plan offered by contracting private companies give all Part A and Part B benefits.

89 Zeilen The Healthcare Reform provides that for plan year 2020 all formulary drugs will have at. New Hampshire Medicare Supplement Plan G Comparison Chart. New Hampshire Nursing Home Plan.

Plan G also offers a high deductible plan. 2020 Custom PPO Medicare Advantage Plan Member Pays In-Network OR Out-of-Network Annual Deductible. Click below to see all 2020 Medicare Advantage or Drug Only Plans available in the County.

Private Fee-for-Service PFFS in New Hampshire. 26 Medicare Advantage Plans available in Carroll County NH. Youll have no copays for preventive care like your yearly check-ups.

In New Hampshire in 2020. They combine the coverage of Original Medicare and Medigap. Medicare Advantage HMO New Hampshire.

The following includes a list of the plans available in New Hampshire. Anthem Blue Cross Blue Shield has a Guarantee Issue for several of their NH Medigap plans for January February and March 2020 If you want to learn more about Medicare Supplement-or Medicare Advantage plans for sale in NH please call Steve Donohue today at 603-882-2909. New Hampshire Medicare Advantage Plans include all the benefits of Original Medicare Parts A and B plus extra benefits for Medicare-eligibles like vision and dental insurance and hearing coverage.

/cdn.vox-cdn.com/uploads/chorus_image/image/69159420/Humana.0.jpg)