Mergers Acquisitions sind unternehmerisch Übernahmen bzw. It states what each party of the merger or acquisition is entitled to and what each is obliged to do under the agreement.

Anderer Wertpapiere oder als Mischform dieser beiden Zahlungsweisen.

M and a deals. Typical deals require the analysis of huge amounts of data in a relatively short period of time. Porsche Behrens Park Now. However the aggregate was still above 2018 when just 43m worth of deals were.

In 2018 the number of deals has decreased by 8 to about 49000 transactions. Lithuania logged total deal value of 154m a 64 decrease from 2019s 434m. An MA deal structure is a binding agreement between parties in a merger or acquisition MA that outlines the rights and obligations of both parties.

The term MA also refers to the desks at financial institutions that deal in such activity. MA Deals are financial transactions in which assets are sold transferred or consolidated between two companies. Estonia accounted for 41 of MA deals overall by volume.

Understanding the Process of Mergers and Acquisitions Mergers and acquisitions MA are complex financial transactions that consolidate companies or assets through various means. According to Market Insider over 24 trillion worth of MA deals were completed from January through October of 2019 and although the deal volume is down just over 11 from January through October of 2018 the average deal size rose considerably. The record of total value of deals took place in 2015 with 24100 bil.

Alle wichtigen Informationen zum. Mergers and Acquisitions MA ist der englische Ausdruck für Fusionen und Übernahmen von Unternehmen. In MA deals there are typically two types of acquirers.

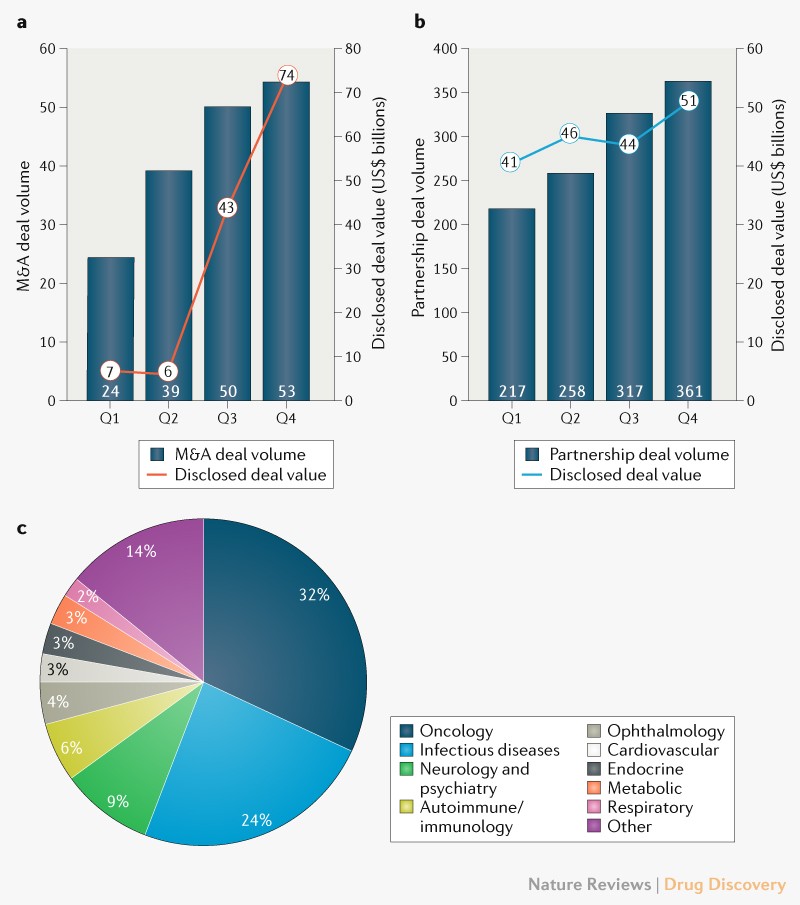

The average deal size rose to over 420 million in 2019 up from just over 380 million in 2018. These figures are barely changed from the year before suggesting that 2020s headwinds have affected the Baltic countries fairly equally. A significant increase in the number of announced megadealsdefined as deals with an announced deal value in excess of 5 billioncontributed to the increase in deal values in the second half of 2020.

Dafür müsst ihr lediglich in unseren Deal-Kategorien die für euch heißesten Angebote und Schnäppchen heraussuchen. Gesetzlich geregelt werden MA-Transaktionen. Daten von Thomson Reuters zufolge wurden im ersten Halbjahr 2018 rund um den Globus MA-Deals im Volumen von insgesamt 25.

Strategic acquirers are other companies often direct competitors or companies operating in adjacent industries such that the target company would fit in nicely with the acquirers core business. Jetzt alle Transaktionen auf einen Blick Mergers Acquisitions Unser internationales und interdisziplinäres Netzwerk ist Ihre Stärke. The compound annual growth rate CAGR for the number of deals from 1985 to 2018 was 586 while the value grew at 532.

Die spannendsten MA-Deals der Woche finden Sie. Key Takeaways The terms mergers and acquisitions are often used interchangeably but they differ in. Number Value of MA Worldwide Since 2000 more than 790000 transactions have been announced worldwide with a known value of over 57 trillion USD.

So when time is money tools that speed up the MA process are critical. Diese Statistik zeigt die Anzahl der MA Deals in Europa im Zeitraum von 1985 bis 2020. Thats why AI-powered.

Financial buyers are institutional buyers such as private equity firms that are. Porsche baut seine Rimac-Beteiligung aus ein ausländischer Investor interessiert sich für Behrens und BMW und Daimler verkaufen Park Now nach Schweden. Auf Basis unserer langjährigen Transaktionserfahrung gestalten wir gemeinsam mit Ihnen eine individuell passende Lösung für Ihre geplante Transaktion sei es auf der Sell- oder Buy-Side in nationalem oder.

Zudem umfasst MA alle Aktivitäten die mit. Die Akquisition der Eigentumsrechte erfolgt dabei entweder direkt über den Kauf von Stimmrechtsanteilen Share Deal oder in Form eines Asset Deals durch den Erwerb aller vorhandener Aktiva und Verbindlichkeiten gegen Bargeld cash offer im Austausch für Aktien des Käufers stock swap bzw. The current trend in 2018 suggests that there will be a decrease in MA this year please see the chart below.

Das weltweite Geschäft mit Firmenkäufen und -fusionen brummt wie noch nie. There were 32 megadeals in the third quarter of 2020 with an additional 25 megadeals in the fourth quarter. Mit diesem Sammelbegriff werden Transaktionen bezeichnet bei denen sich Unternehmen oder andere Gesellschaften zusammenschließen oder eine Gesellschaft von einer anderen gekauft und integriert wird.

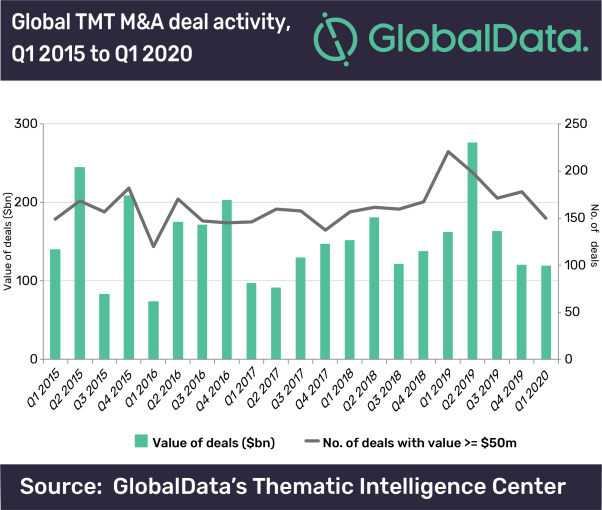

Covid 19 Depressed Tmt M A Deals Activity By 40 In H1 2020 Globaldata

Covid 19 Depressed Tmt M A Deals Activity By 40 In H1 2020 Globaldata

China S M A Activity Rebounds With A Clear Focus On Europe Bruegel

China S M A Activity Rebounds With A Clear Focus On Europe Bruegel

M A Deals By Sector In Poland Cee 2018 Statista

M A Deals By Sector In Poland Cee 2018 Statista

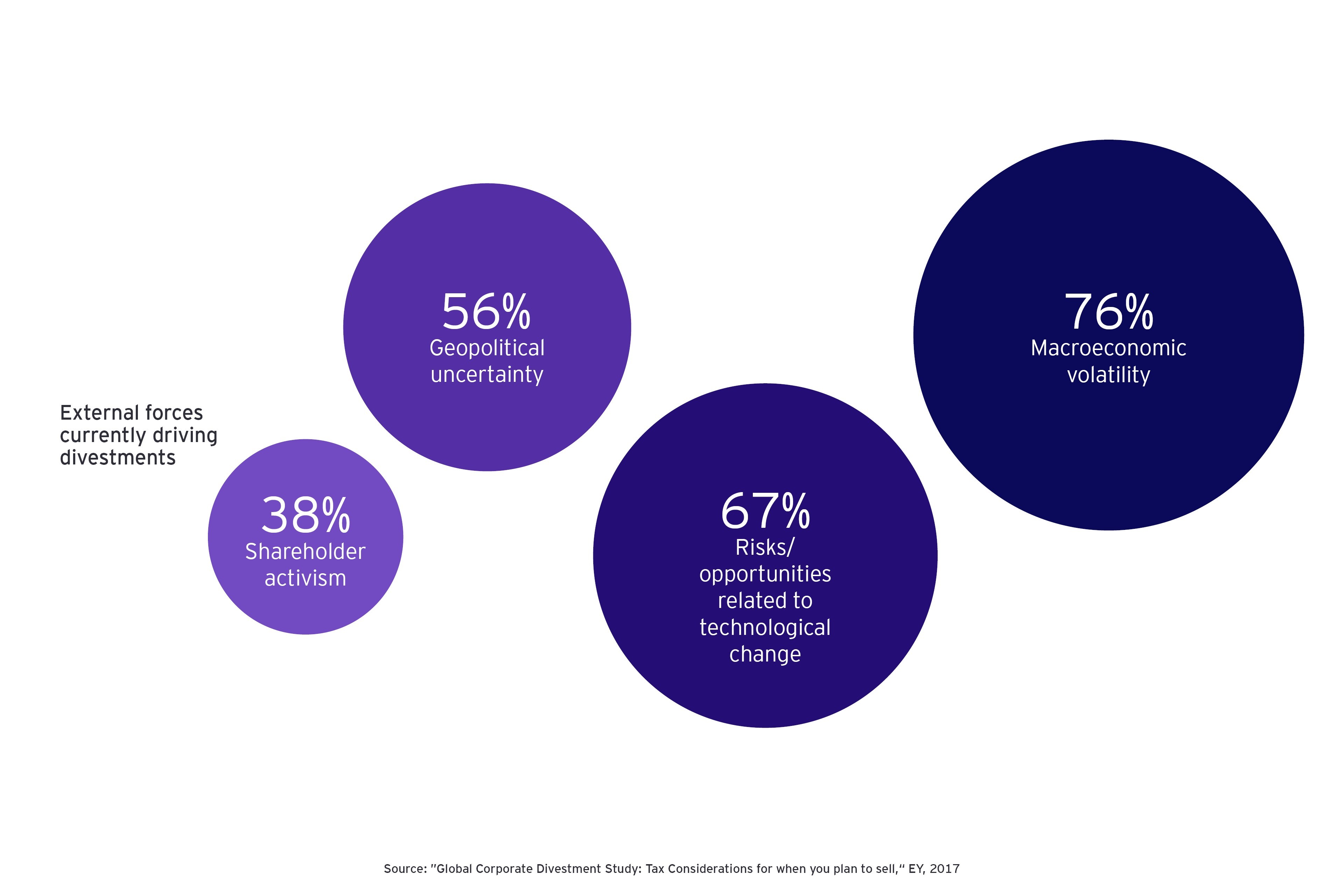

How Shifting Tax Rules Can Complicate M A Deals Ey Global

How Shifting Tax Rules Can Complicate M A Deals Ey Global

M A Deals By Value In Czechia 2020 Statista

M A Deals By Value In Czechia 2020 Statista

M A Deals By Volume In Cee 2020 Statista

M A Deals By Volume In Cee 2020 Statista

How Have Covid 19 Fears Impacted Distribution Sector M A Deals And Valuations Oaklins Netherlands Mid Market M A And Financial Advice Globally

How Have Covid 19 Fears Impacted Distribution Sector M A Deals And Valuations Oaklins Netherlands Mid Market M A And Financial Advice Globally

Covid 19 Slowed Tmt M A By 26 Q1 2020 With Worse To Come Globaldata

Covid 19 Slowed Tmt M A By 26 Q1 2020 With Worse To Come Globaldata

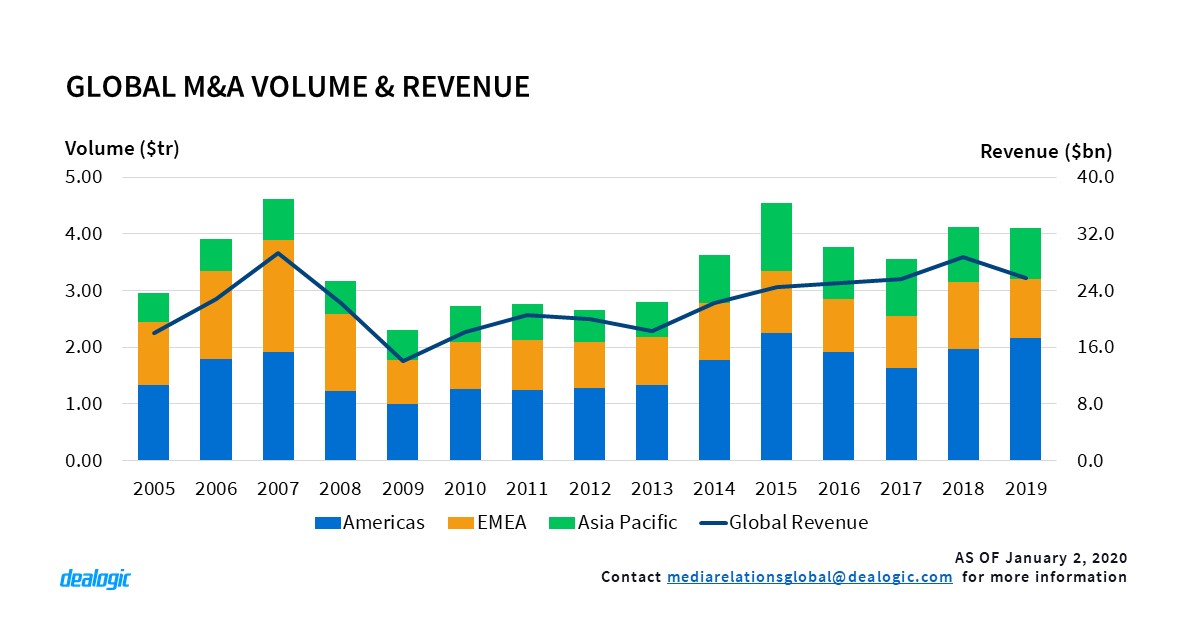

M A Highlights Full Year 2019 Dealogic Com

M A Highlights Full Year 2019 Dealogic Com

Regional Distribution Of M A Deals By Value 2012 Statista

Regional Distribution Of M A Deals By Value 2012 Statista

M A Deals By Value In Poland Cee 2020 Statista

M A Deals By Value In Poland Cee 2020 Statista

Cracking The Code Of Digital Mergers Acquisitions M A

Cracking The Code Of Digital Mergers Acquisitions M A

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.