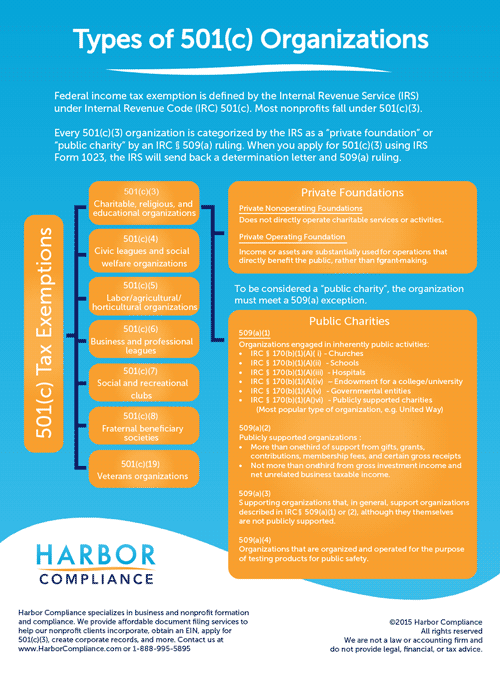

Complete searchable list of IRS registered 501c non profit organizations and charities. In effect the definition divides section 501c3 organizations into two classes.

Irs 501 C Subsection Codes For Tax Exempt Organizations Harbor Compliance

Irs 501 C Subsection Codes For Tax Exempt Organizations Harbor Compliance

44 rows 501c3 Charitable Organization Hospital Specialty 011959.

501 c 3 hospitals list. 170 provides a deduction for federal income tax purposes for donors who make charitable contributions to most types of 501c3 organizations 2. FURMAN UNIVERSITY co AMY BARNHILL 1 billion 3300 POINSETT HWY GREENVILLE SC 29613-0002. Organizations that meet the requirements of Section 501c3 are.

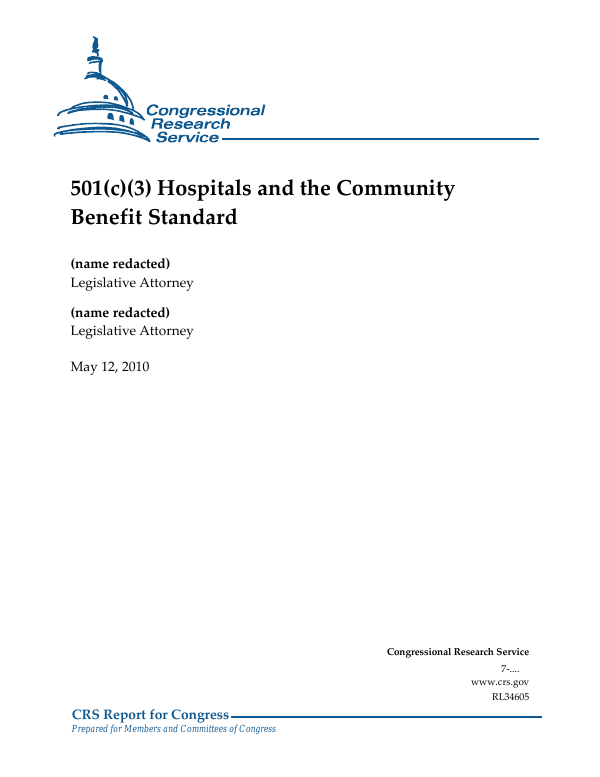

New Requirements for Charitable 501c3 Hospitals Section 501r added to the Code by the ACA imposes new requirements on 501c3 organizations that operate one or more hospital facilities hospital organizations. Childrens Miracle Network Hospitals raises funds and awareness for 170 member hospitals that provide 32 million treatments each year to kids across the US. Section 501c3 is a portion of the US.

JAWS users will need to request these files. Are churches hospitals qualified medical research organizations affiliated with hospitals schools colleges and universities. Private foundations and public charities.

Each 501c3 hospital organization is required to meet four general requirements on a facility-by-facility basis. 501c2 Title holding corporations for exempt organizations. What is a 501c3.

It is one of the 29 types of 501c. Form 990PF 501c3 Private Foundations Form 990T 990T returns for 501c3 organizations only Note. Organizations on the auto-revocation list with a revocation date between April 1 and July 14 2020 should have a revocation date of July 15 2020.

Exemption Type IRC section Description. 500 million 800 N FANT ST. You can review the list of organizations that have filed forms in the Form 990 Series.

Generally organizations that are classified as public charities are those that. 501c3 Religious educational charitable scientific literary testing for public safety fostering national or international amateur sports competition or prevention of cruelty to children or animals organizations. The Affordable Care Act ACA enacted March 23 2010 added new requirements that hospital organizations must satisfy in order to be described in section 501c3 as well as new reporting and excise taxesThis means many critical updates are required of an organizations Financial.

New Requirements for 501c3 Hospitals Under the Affordable Care Act and your Financial Assistance Policy. In addition it may not be an action organization ie it may not attempt to influence legislation as a substantial part of its. From what I understand my residency program a county hospital counts so that just leaves an additional 6 years while Im an attending.

To be tax-exempt under section 501c3 of the Internal Revenue Code an organization must be organized and operated exclusively for exempt purposes set forth in section 501c3 and none of its earnings may inure to any private shareholder or individual. MEMORIAL SLOAN-KETTERING CANCER CENTER. CORNELL UNIVERSITY co UNIVERSITY CONTROLLER 10 billion 341 PINE TREE RD ITHACA NY 14850-2820.

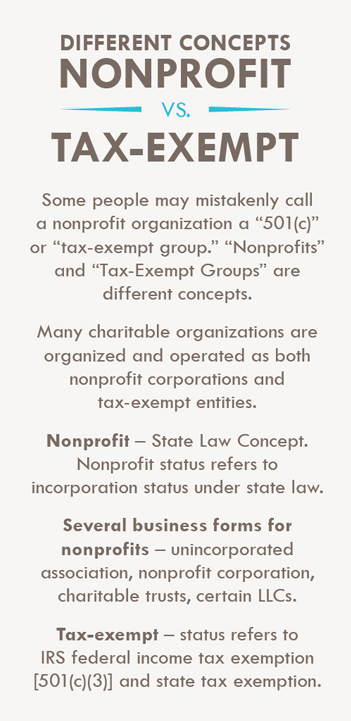

Wikipedia defines it this way. One of the most distinct provisions unique to Section 501c3 organizations as compared with other tax exempt entities is the tax deductibility of donations. See Revocation Date of Certain Organizations for details.

Itd probably be more useful to have a listing of hospitals that are NOT 501c3 since. Other unique provisions tend to vary by state. 501c3 Charitable Organization University or Technological Institute 101951.

501c3 Charitable Organization Hospital General 062016. Internal Revenue Code IRC and a specific tax category for nonprofit organizations. 501c3 organization is a organization fas trust unincorporated association or other type of organization exempt from federal income tax under section 501c3 of Title 26 of the United States Code.

Childrens Miracle Network Hospitals Salt Lake City UT. 501c3 Educational Organization Undergraduate College 4-year 081937. 501c3 Charitable Organization Hospital General 121997.

Looking at all my options PSLF seems pretty awesome with the loan forgiveness which would require me to do 10 years at a public institution that is 501c3. If you use the first two sites you have to narrow down your search results with a component of the hospital name since they list all nonprofits not just hospitals.

Common 501 C 3 Rules And Regulations Boardeffect

Common 501 C 3 Rules And Regulations Boardeffect

Https Www Theaiatrust Com Filecabinet D O Insurance Primer Pdf

What Is The Difference Between Nonprofit And Tax Exempt

What Is The Difference Between Nonprofit And Tax Exempt

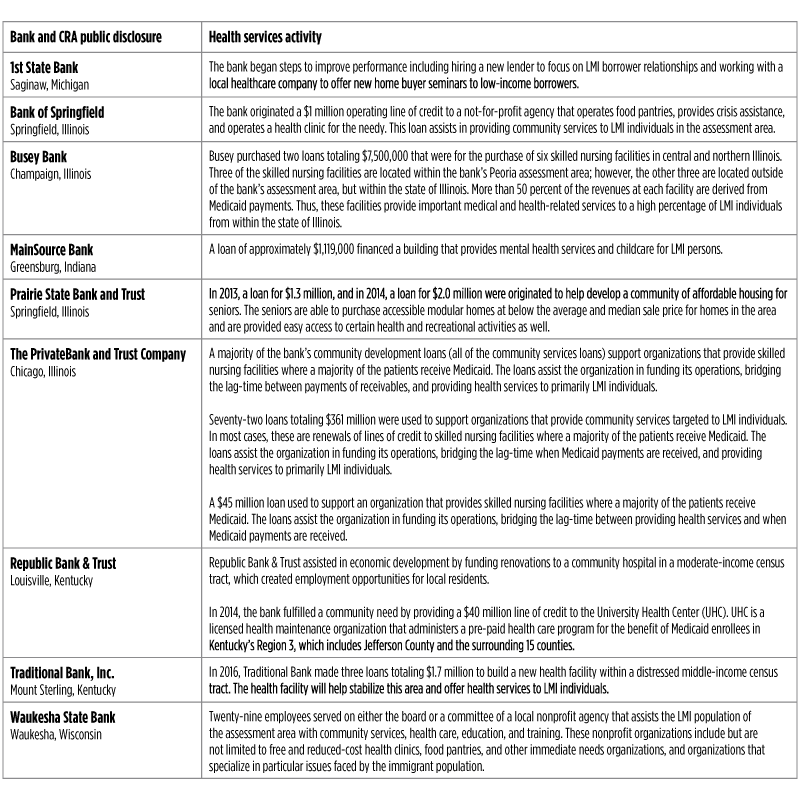

Banks And Nonprofit Hospitals Partners In Community Development How Banks And Nonprofit Hospitals Can Collaborate On Community Building And Health Outcome Improvement Exploring The Nexus Between The Community Reinvestment Act Cra And

Banks And Nonprofit Hospitals Partners In Community Development How Banks And Nonprofit Hospitals Can Collaborate On Community Building And Health Outcome Improvement Exploring The Nexus Between The Community Reinvestment Act Cra And

Hospital Requirements List Planning Resources By Setting Hospitals And Healthcare Systems

Hospital Requirements List Planning Resources By Setting Hospitals And Healthcare Systems

Federal Cares Act For Nonprofits Pandemic Stimulus Insidecharity Org

Federal Cares Act For Nonprofits Pandemic Stimulus Insidecharity Org

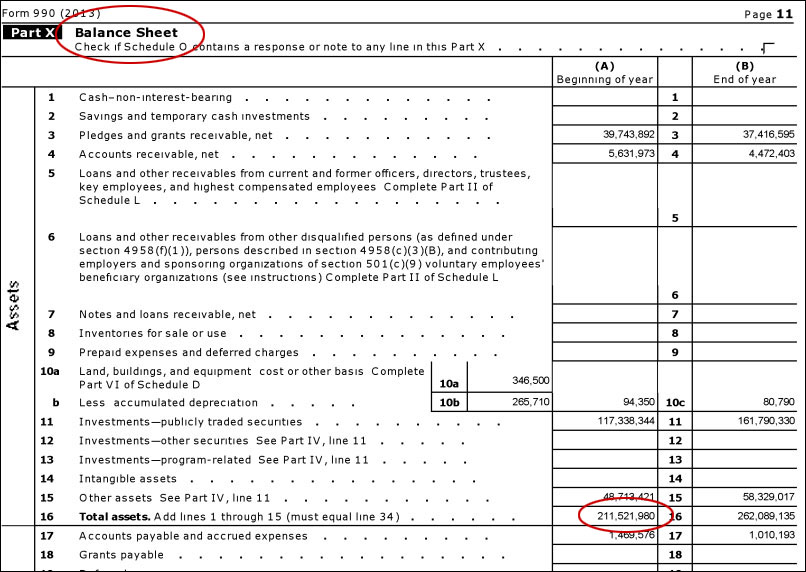

Investigating Nonprofits And Charities Where To Find Internal Data Public Records The Journalist S Resource

Investigating Nonprofits And Charities Where To Find Internal Data Public Records The Journalist S Resource

Https Www Irs Gov Pub Irs Drop N 15 46 Pdf

Http Www Georgiawatch Org Wp Content Uploads 2016 04 List Of Nonprofit Hospitals April 2015 Pdf

Doctor Jobs At Nonprofit 501 C 3 Hospitals Don T All Qualify For Pslf Ben White

Doctor Jobs At Nonprofit 501 C 3 Hospitals Don T All Qualify For Pslf Ben White

501 C 3 Hospitals And The Community Benefit Standard Everycrsreport Com

501 C 3 Hospitals And The Community Benefit Standard Everycrsreport Com

Investigating Nonprofits And Charities Where To Find Internal Data Public Records The Journalist S Resource

Investigating Nonprofits And Charities Where To Find Internal Data Public Records The Journalist S Resource

501 C 3 Non Profit Listing On Irs Gov Illinois Science Olympiad

501 C 3 Non Profit Listing On Irs Gov Illinois Science Olympiad

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.