You cannot charge the client more than what insurance would have traditionally paid. Part D deductibles vary by plan but by law must be 435 or lower in 2020.

How Health Insurance Works Money Matters

How Health Insurance Works Money Matters

Preventive Care Not Subject to Deductible.

How medical deductibles work. Your health insurance deductible is what you pay for covered services before your plan. When trying to understand how deductibles work its imperative that you understand the difference between your deductible and your out-of-pocket maximum or limit. How Does the Medicare Deductible Work.

This deductible will reset each year and the dollar amount may. Here are 6 important things to know about deductibles. The main benefit of a deductible is that you will save money on your premium.

Each time an individual within the family pays toward his or her individual deductible that amount is also credited toward the family deductible. Even if your cash rate is higher you need to charge the client the lower insurance approved rate. As each family member incurs medical expenses the amount they pay toward these expenses is credited toward the familys deductible.

Most family health insurance policies have both individual deductibles and family deductibles. For example lets say you break your wrist. Insurance companies negotiate their rates with providers and youll pay that discounted rate.

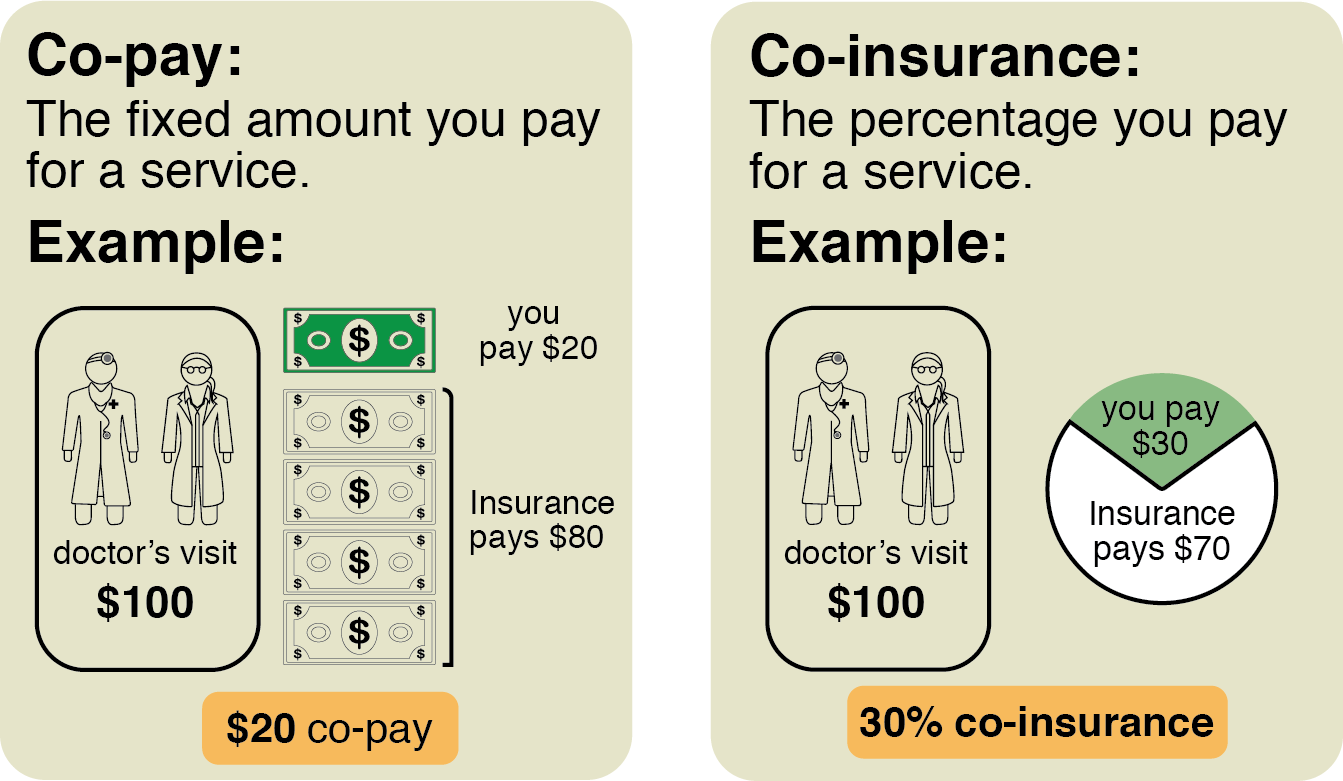

If you have a deductible you pay the full negotiated costs of all in-network services until you reach the deductible. Typically youd pay a certain percentage of covered costs and your policy provider would pay the rest. If your plan has a 1000 annual deductible and you use a covered healthcare service that costs 200 youll pay 200 fully out of pocket and have 800 remaining for your annual deductible.

Medicare Part D is optional coverage you can buy to help pay for prescription drugs. 3 After you meet this deductible youll pay a. The Medicare Part B deductible for 2020 is 198 in 2020.

Choosing your insurance deductible. Health-care costs can add up fast. Once a covered family member meets the individual deductible your insurance will begin paying benefits for that family member.

How Do Insurance Deductibles Work. With most coverages you can adjust your deductible making it a valuable. So the larger the deductible the greater the discount on.

If your plans deductible is 1500 youll pay 100 percent of eligible health care expenses until the bills total 1500. Not every health plan has a deductible and this amount may vary by plan. How Deductibles Work The deductible is what you pay out of your own pocket before your insurance begins to pay a share of your costs.

Having health insurance can lower your costs even when you have to pay out of pocket to meet your deductible. 6657 15 paid by client 924 paid by BCBS no deductible remains 6th visit. Understanding how medical costs and insurance are related and structured may help you anticipate expenses and budget bette.

A deductible is a set amount you may be required to pay out of pocket before your plan begins to pay for covered costs. It Depends on Your Medical Coverage Level Silver Gold and Platinum Coverage Level s. 15 paid by client 7581 Paid by BCBS.

Every year it starts over and youll need to reach the. Once a covered family member meets the individual deductible your insurance will begin paying benefits for that family member. After that you share the cost with your plan by.

When these expenses add up to the family deductible the HDHP coverage kicks in and starts paying its share of the cost of health care expenses for each member of the family. How a Family Deductible Works. These coverage levels have a traditional deductible.

Your deductible is the amount of money you have to pay for your prescriptions and healthcare before Original Medicare other insurance or your prescription drug plan starts paying for your healthcare expenses. Like the Part B deductible this one resets annually too. Put simply a deductible is the amount of money that you have to pay on your own behalf before your plan will kick in and start to cover eligible medical costs.

It Depends on Your Medical Coverage Level Silver Gold and Platinum have a traditional deductible. A deductible is the amount you pay for health care services before your health insurance begins to pay. Oftentimes after you pay your deductible your insurer will begin paying a certain percentage of your covered services.

How a Health Insurance Deductible Works Lets look at a quick example.