Some states have their own individual health insurance mandate requiring you to have qualifying health coverage or pay a fee with your state taxes for the 2019 plan year. The individual shared responsibility provision requires taxpayers to do at least one of the following.

Health Care Reform The Individual Mandate Mnj Insurance Solutions

Health Care Reform The Individual Mandate Mnj Insurance Solutions

This essay situates PPACAs mandate and the opposition to it in that.

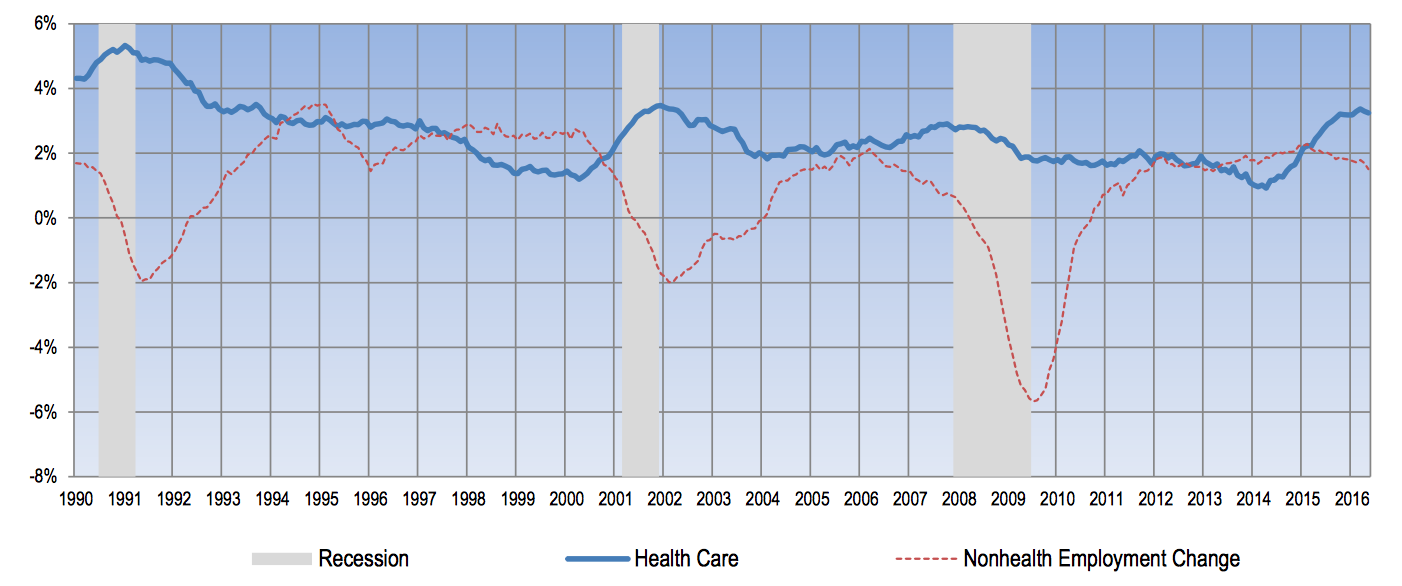

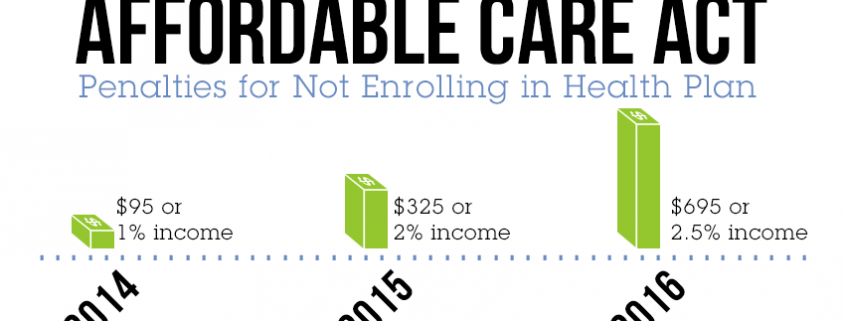

Individual mandate healthcare. Separately in The New England Journal of Medicine last year researchers concluded that the individual mandates exemptions and penalties had little impact on coverage rates Instead they found. The health care reform legislation that became law in 2010 - known officially as the Affordable Care Act and also as Obamacare - requires most Americans to have a basic level of health insurance coverage. For tax year 2019 and 2020.

The individual mandate was included in ObamaCare in part to draw young and healthy people to sign up for insurance in the marketplaces as a way to offset the costs of older and sicker enrollees. As of 2019 the Obamacare Individual mandate which requires you to have health insurance no longer applies at the federal level. Congress is now weighing different versions of a requirement that individuals obtain health insurance.

These public health mandates have also often aroused deep opposition. We begin 2018 with a major change settling into the health-care industry. Learn more about this provision.

The individual mandate is a provision within the Affordable Care Act that required individuals to purchase minimum essential coverage or face a tax penalty unless they were eligible for an exemption. You may have to pay a penalty for not having health insurance if you live in one of the following. In 1993 Republicans twice introduced health care bills that contained an individual health insurance mandate.

This requirement is commonly referred to as the laws individual mandate The law imposes a tax penalty through 2018 on those who fail to have. The State of California adopted a new state individual health care mandate that requires individuals to maintain health insurance beginning January 1 2020. If you live in a state that requires you to have health coverage and you dont have coverage or an exemption.

Individuals who do not obtain health insurance for themselves and their dependents will be subject to a penalty unless they qualify for an exemption. Critics claim that the mandate represents an unprecedented attempt by the federal government to compel individual action. Yet states frequently employ similar mandates to protect the publics health.

It was a key part of the coverage plan that Gov. Who was affected by the individual mandate. Have qualifying health coverage called minimum essential coverage Qualify for a health coverage exemption Make a shared responsibility payment with their federal income tax return for the months that without coverage or an exemption.

IRS Individual Shared Responsibility Provision page IRS Individual Shared Responsibility Provision QA. The individual mandate was originally a conservative idea pushed in response to President Bill Clintons 1994 health-care plan. As of January 1 2019 the Individual Mandate requiring most Americans to have health insurance or pay a penalty has been effectively repealed due to the Tax Cuts and Jobs Act which zeroed out the penalty.

The removal of the individual mandate which required all Americans to acquire health insurance coverage or risk paying a. Advocates for those bills included prominent Republicans who today oppose the mandate including Orrin Hatch R-UT. A federal appeals court rules that the Affordable Care Acts individual mandate provision is unconstitutional but punts on deciding whether the rest of the landmark health-care law should be tossed.

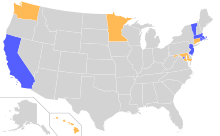

The concept of the individual health insurance mandate is considered to have originated in 1989 at the conservative Heritage Foundation. Youll be charged a fee when you file your 2019 state taxes. However 5 states and the District of Columbia have an individual mandate at the state level.